The very nature of reliability and security that is attached to properties and real estate has earned the name ‘Real Asset’ for investment in this sector. When it comes to long-term investment and industry bench-mark returns, there is no other sector than property and real estate investment. A master diamantaire can only claim to possess the art of identifying gemstones, and chisels it to increase the value and quality of a rough diamond. Likewise Bee’s Cap team of property experts put together years of experience from global property investments to identify premium properties from across the world, and buy them at the RIGHT TIME and RIGHT PRICE to MAXIMUM RETURNS.

The very idea behind Bee’s Cap is to garner funds to invest in the lucrative property market. Bee’s Cap is a combination of Mortgage and Property fund managing company.

Australia Calling

The focus property markets for Bee’s Cap are emerging economies like Australia and Asia. Unlike saturated real estate markets of the West, emerging economies have the potential to add more value while offsetting volatility. With about 25 million population and landmass which accounts for 5% of the world’s total habitable land area, Australian property market is on a phenomenal growth track. A host of pro-investment policies by the Australian government, stable economy and rising demand for quality properties have made the country’s real estate sector very lucrative. Bee’s Cap found immense potential in markets like Australia, which has rich natural and mineral resource but it lacks the financing to make use of its resources. Hence, Bee’s Cap is founded as a Mortgage Fund to raise capital to fund projects with the potential of high return. The company also has high value properties for development in Australia. It is a country with enormous growth opportunities but relatively untapped market making it a highly lucrative region for long-term growth.

The focus property markets for Bee’s Cap are emerging economies like Australia and Asia. Unlike saturated real estate markets of the West, emerging economies have the potential to add more value while offsetting volatility. With about 25 million population and landmass which accounts for 5% of the world’s total habitable land area, Australian property market is on a phenomenal growth track. A host of pro-investment policies by the Australian government, stable economy and rising demand for quality properties have made the country’s real estate sector very lucrative. Bee’s Cap found immense potential in markets like Australia, which has rich natural and mineral resource but it lacks the financing to make use of its resources. Hence, Bee’s Cap is founded as a Mortgage Fund to raise capital to fund projects with the potential of high return. The company also has high value properties for development in Australia. It is a country with enormous growth opportunities but relatively untapped market making it a highly lucrative region for long-term growth.

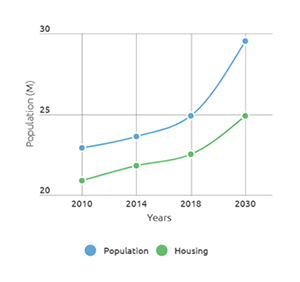

It is time for you to join hands with Bee’s Cap and be a part of the great Australian growth journey. The potential of this market and welcoming offshore investor policy have attracted investors from London, Japan, China, Europe and Middle East. The housing market now stands roughly at $7.2 trillion, and it is in want of fresh investments. Australian property market has clocked consistent growth of about 7% per annum in the last couple of decades. Investment in property has ensured 100% return in about 7- 10 years timeline, which has compounded with the leverage of the property, making Australia much more rewarding than any other market of the West. An increasing population is likely to create demand for about 6.2 lakh houses by the year 2030. With a vibrant and diversified economic growth of 2-3%, rich mineral and natural reserve, and liberal tax benefit for investors make the country a secure investment destination.

Long and serene coastline, sophisticate yet sedate lifestyle, vibrant economy, and a relatively virgin and less populated landmass is making Australia a preferred destination to do business and live for people from across the world. These very characteristics of Australia have attracted many European, American and Asians to choose it as their home. Now a major inflow of investment comes from China and the West because they realised much better return on their investment in Australia than volatile and stagnant property markets of the US, the UK or the Middle East.

The Bee’s Cap Edge

Every new market requires guidance of professionals to mitigate risk and maximise profit. Bee’s Cap with its rich understanding of Australian property market and strategic holding of market intelligence report about key regions like Sydney and Melbourne gives its clients an wining the edge.

Crowd funding: Bee’s Cap Property Investment Fund has developed this unique model to allow small and individual investors to reap the dividend from the sky rocketing Australia real estate sector. Investors interested in the lucrative property market but lack enough funds to go solo, can now make investment through our shareholding mode in the Australian market. It allows smaller investors to be a co-owner of major commercial property investments.

Investment strategy: Our investment is driven by dedicated research team that garners early market intelligence and information on government decisions on future projects and plans to develop central infrastructure for residential, commercial, agricultural, tourism, hospitality and industrial zones. It allows us to gain upper hand over competition, and invest into properties where we can get more value for our investors.

Bee’s Cap generates funds from various countries, including Australia, who are invested through Unit Trust allowing our clients the flexibility and scalability. In a bid to maximise investment, our team works relentlessly to get Mortgage Fund through Bee’s Cap by investing in start-ups with great products and services, and potential for long-term future growth.

Copyright © 2017 All rights Reserved.